In this economy, every penny counts and this means being smart about how you manage your money. One tool that you probably can’t afford to miss out on is a high yield savings account or HYSA for short.

High yield savings accounts have been around forever. But recently, the interest rates for HYSAs has been really competitive. Everyone needs a savings account, and if you don’t have a HYSA yet or aren’t sure how to choose the best one for you here’s what you need to know.

Understanding High Yield Savings: More Than Just a Stash

At its core, a high yield savings account is a type of savings vehicle offered by banks and credit unions. It gives account owners higher interest rates than those typically found in standard savings accounts. These interest rates are compounded, meaning that the interest is calculated on the initial principal and also on already accumulated interest. This compounding effect multiplies your savings faster than a regular savings account, and, boy, does it add up over time.

Benefits of a High Yield Savings Account

There are several benefits to having a HYSA but the biggest one is compound interest. Imagine your money is a seed, and the high yield savings account is the fertile soil. As the seed grows into a plant, it simultaneously generates more seeds, all of which can be planted to produce even more plants.

In the financial realm, your initial deposit earns interest, and then, that interest earns interest. This cycle of reinvestment allows your savings to grow exponentially, creating a wealth-building machine. Thanks to compound interest, having a HYSA can help you reach your financial goals faster especially if you’re saving up for a home, a car, or a large purchase. Or, if you’re looking to build an emergency fund, you’ll reach that goal quicker with a HYSA to grow your balance with interest.

HYSAs also tend to have lower fees or no fees or minimum deposit requirements especially if they are offered through online banks. Online banks can afford to provide better interest rates to customers sicne they don’t have to spend money on physical locations and in-person staff.

Factors to Consider when Choosing a High Yield Savings Account

Not all high yield savings accounts are created equal. When diving into the market, several factors demand your discerning eye.

- Interest. Interest rates fluctuate, but the best high yield savings accounts offer rates that outperform inflation, ensuring that your money keeps its value and then some. Watching these rates can mean the difference between saving comfortably and saving exceptionally. Recently, interest rates for HYSAs have been as high as 4.3% to 5%.

- Fees and penalties. Sometimes, the pursuit of higher returns can come with unexpected costs. While most HYSAs have few or no fees, some may have hidden fees such or penalties related to minimum balance requirements or excessive withdrawal fees. Being aware of these fees is crucial to maximizing your savings so be sure to shop around and compare the fine print when comparing your options.

- Accessibility and convenient. Some accounts might offer astronomical interest rates, but if you can’t access your money when you need it, what good is the interest? It’s important to make sure the bank is convenient for your needs and you can access and transfer your funds in a timely manner when needed. Online banking, mobile apps, and ATM access can also play a significant role in your overall satisfaction with your high yield savings account.

An Example of Saving with a High Yield Savings Account

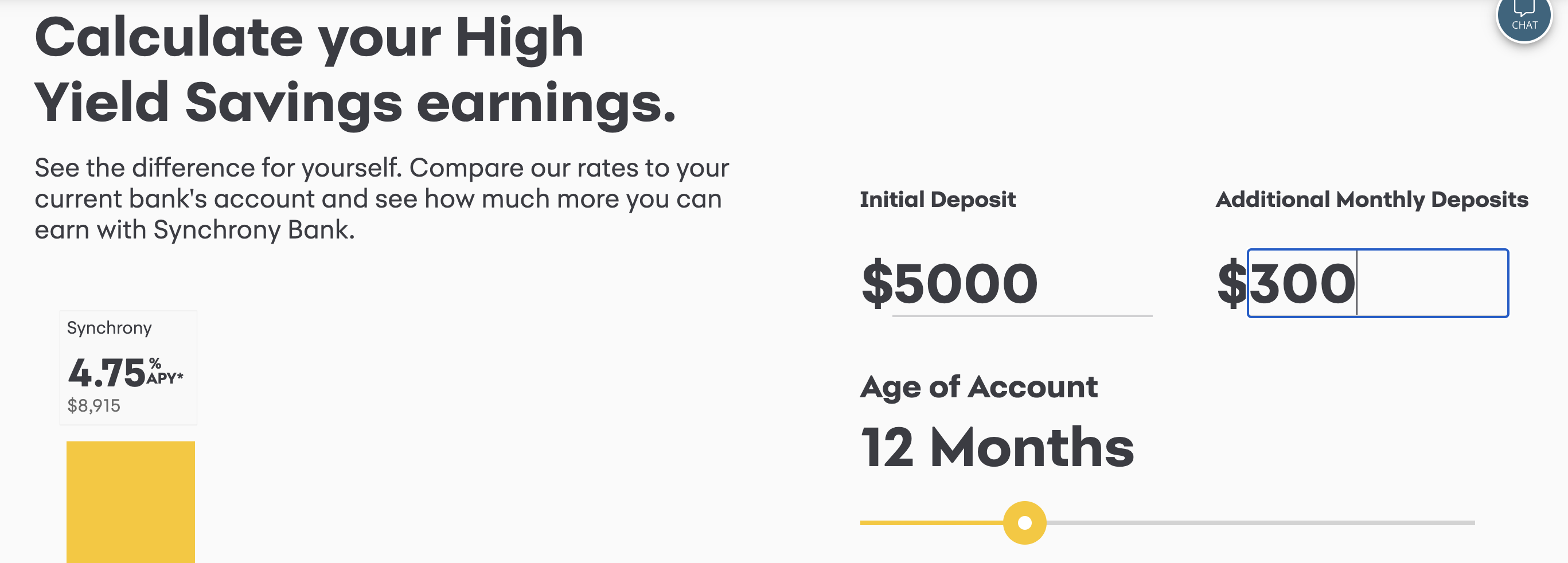

Maybe you already have a savings account at your current bank and you’re wondering if switching to a HYSA is really worth all the trouble. Let’s take a look at how much you’d earn if you opened an account with Synchrony Bank for example. Currently, Synchrony has a 4.75% APY for its HYSA. This account also has no minimum deposit or minimum balance requirements and no monthly fees.

The website has a free savings calculator you can use to predict your progress. So if you started with an an initial deposit $5,000 and made monthly deposits of $300 for a year, you’d end up with $8,915 after 12 months thanks to your consistent savings habits and compound interest.

Even if you made this initial deposit and didn’t add any additional money to your account for a year, you’d end up with a balance of $5,237 after interest payments. This may not seem like much but it adds up overtime and it’s a lot better than the pennies you might be getting on your savings balance at a traditional bank.

Getting Started

There are some great HYSA options available right now at various banks including Capital One, Ally, Synchrony Bank, CIT Bank, and Discover just to name a few. All you need to do is narrow down your selection and apply online for the easiest and fastest results.

You’ll need the same information you’d need to apply for a regular bank account like your address, social security number and other financial information. Once your account is open, you can connect an external bank account to fund your account or even set up automatic deposits.

Maximizing Your Results

Once you open a HYSA, consider setting up automated transfers from your checking to your high yield savings account. This will transform sporadic saving into a consistent and successful financial habit. It’s like having a personal savings assistant that you barely ever have to pay.

Also, make sure you’re consistent with monitoring your account and budgeting for savings. Developing a saving routine can turn lofty financial dreams into tangible and reachable targets. Setting aside a portion of each paycheck ensures a steady and reliable growth in your high yield account.

Summary

A high yield savings account can be the cornerstone of your financial stability and a catalyst for achieving your most audacious economic dreams. With the power of compound interest, strategic saving habits, and a diligent approach to account management, you can transform your financial future and embrace a life rich in possibility and comfort. So, go forth, wise savers, and unlock the potential of your money by harnessing the formidable force that is the high yield savings account.

Ready to learn more actionable tips? Download the free guide!

0 Comments